Commercial Truck Insurance

& Personal Insurance services

Proudly Serving The Greater Indianapolis Area

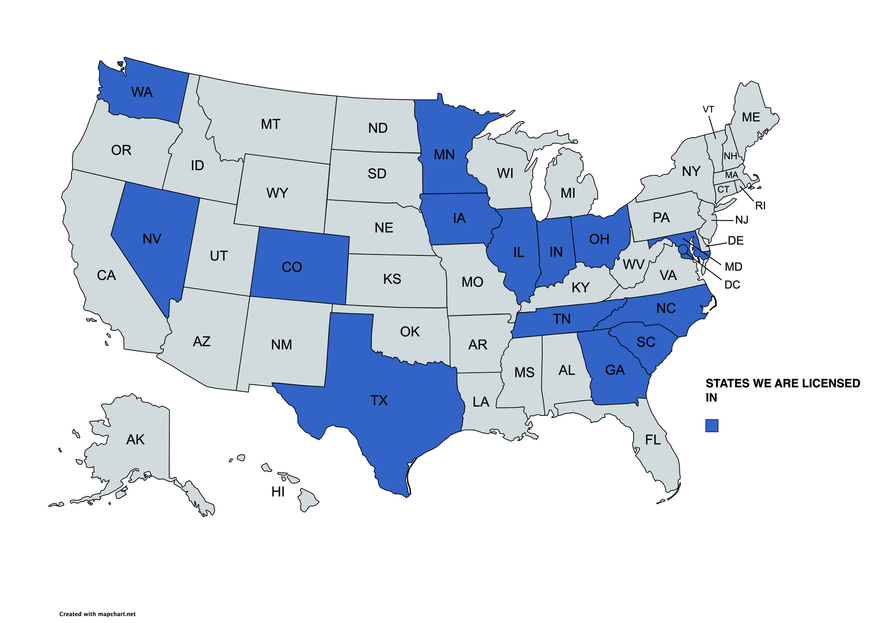

States we are licensed in :

Selam Insurance Services is licensed to sell commercial truck insurance in the states listed below.

Our Services

Our clients tell us we're their one-stop shop for insurance and tax services. With a focus on client satisfaction, we offer a range of services, including commercial truck insurance, auto insurance, homeowners insurance, renters insurance, and tax services. Our knowledgeable team works closely with clients to understand their unique needs and provide tailored solutions at competitive rates.

Why people believe in us

"I Have had my insurance with Selam Insurance Services since 2021, it is by far the best customer Service that I have ever experienced with an insurance agency.

Beside the insurance service, Yosief is Knowledgeable and helpful in any issue related to trucking. thank You Jocy"

Solomon Kelati

AKI TRANSPORT, NC

"My premium with my previous insurance was too much until I switched with the help of Selam Insurance.

Not only did they save me $3700 per year but they also offered me better coverage with a lesser deductible."

Sami Abebe

DANI TRUCKING, GA

"Selam Insurance recently saved me $2500 per year and it was no hassle to switch.

I really enjoy the friendship I have with Jocy. He is like a big brother and ready to help.

The customer service is exceptional."

AKLILU Okbamichael

G Crown LLC, TN

"Whenever I needed a CERTIFICATE of Insurance , I was wasting a lot of time on the phone. Recently I have changed my agency to Selam Insurance services and my problem is completely solved. Jocy is available 24/7 to deliver COI on time and to answer my questions. Absolutely glad to work with Selam Insurance."

Samuel Habtezion

DUNGA TRUCKING,OH

"They help me to get a huge discount, compared to other agents.

They have absolute communication when You need some help either by email or phone call. I recommend to anyone who needs great customer service."

Aman Hagos

Ephrata Transportation, Tx

"Recently I had a claim and the support provided by the agent was exceptional.

It was far beyond what I expected.

I am really satisfied, and I would highly recommend Selam Insurance and Yosief to anyone."

Mekonnen Sebsibe

SHIPPERS GATE LOG, TX

"Beside their wonderful Insurance service, Yosef made the whole process of starting and running my trucking business so much easier. I would recommend him to anyone who needs help to get a new DOT and MC number."

Amanuel Negguse

PEACE TRUCKING, IN

Get Started Today

Have a question? We’re always here to help! Fill out the form below and we will be in touch with you as soon as possible.

FREQUENTLY ASKED QUESTIONS

Please browse through the information below for answers to some commonly asked questions about Selam Insurance Services. If you do not find the answer to your question below, please contact us and one of our agents will help you with your inquiry.